2026 Market Predictions

..or lack thereof.

Every year, Wall Street’s top strategists predict, prognosticate, and pontificate on the whims of the market. Overly complex ways of saying: they guess.

But no one has a crystal ball. As Yogi Berra put it:

“It’s tough to make predictions, especially about the future.”

I’d add “particularly when future expectations are already priced into stock market prices.”

5-min read or 11-minute watch below.

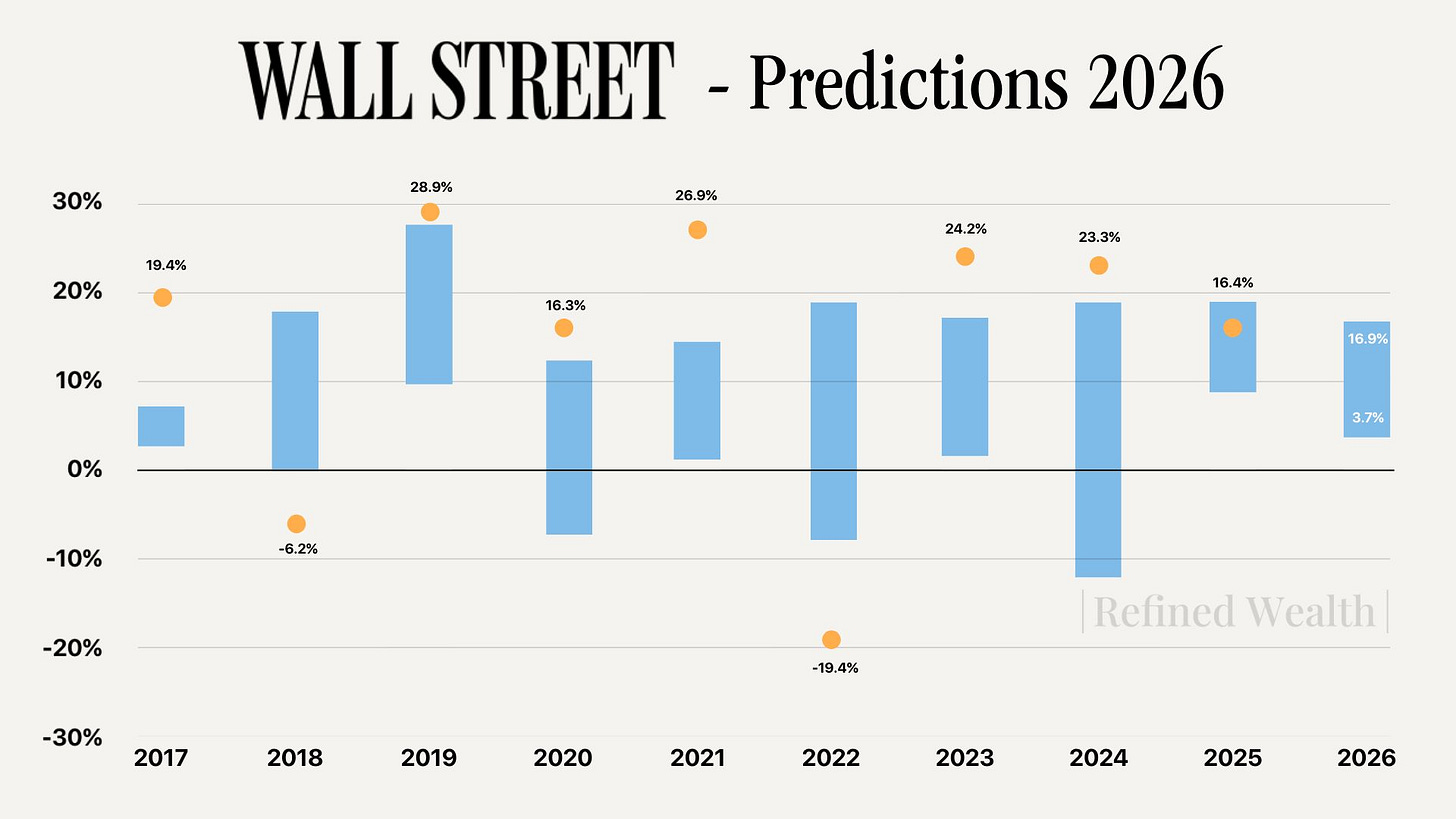

From 2017 to 2024, the collective wisdom of Wall Street was 0-for-8. Meaning for eight straight years, actual S&P 500 results didn’t even fall within the range of the most optimistic and pessimistic forecasts.

The blue bars below represent the range of predictions across the big banks for the year ahead. The orange dots represent the actual returns.

For example, in 2025, Wells Fargo was the optimist and predicted the S&P 500 would rise 19%, whereas many others like UBS predicted only a moderate 9% increase. The actual return? Around 16%. Higher than most expected but still within the range.

What’s worse? Last March, most banks were revising down their previously rosy estimates. Then in April 2025, forecasts were upended when the market dropped 15.28% year-to-date following tariff policy announcements.

I didn’t hear anyone in the media suggest a 30% gain in the remaining nine months of the year.

The takeaway: Making investment moves based on yearly predictions has been a losing battle.

So what should you do?

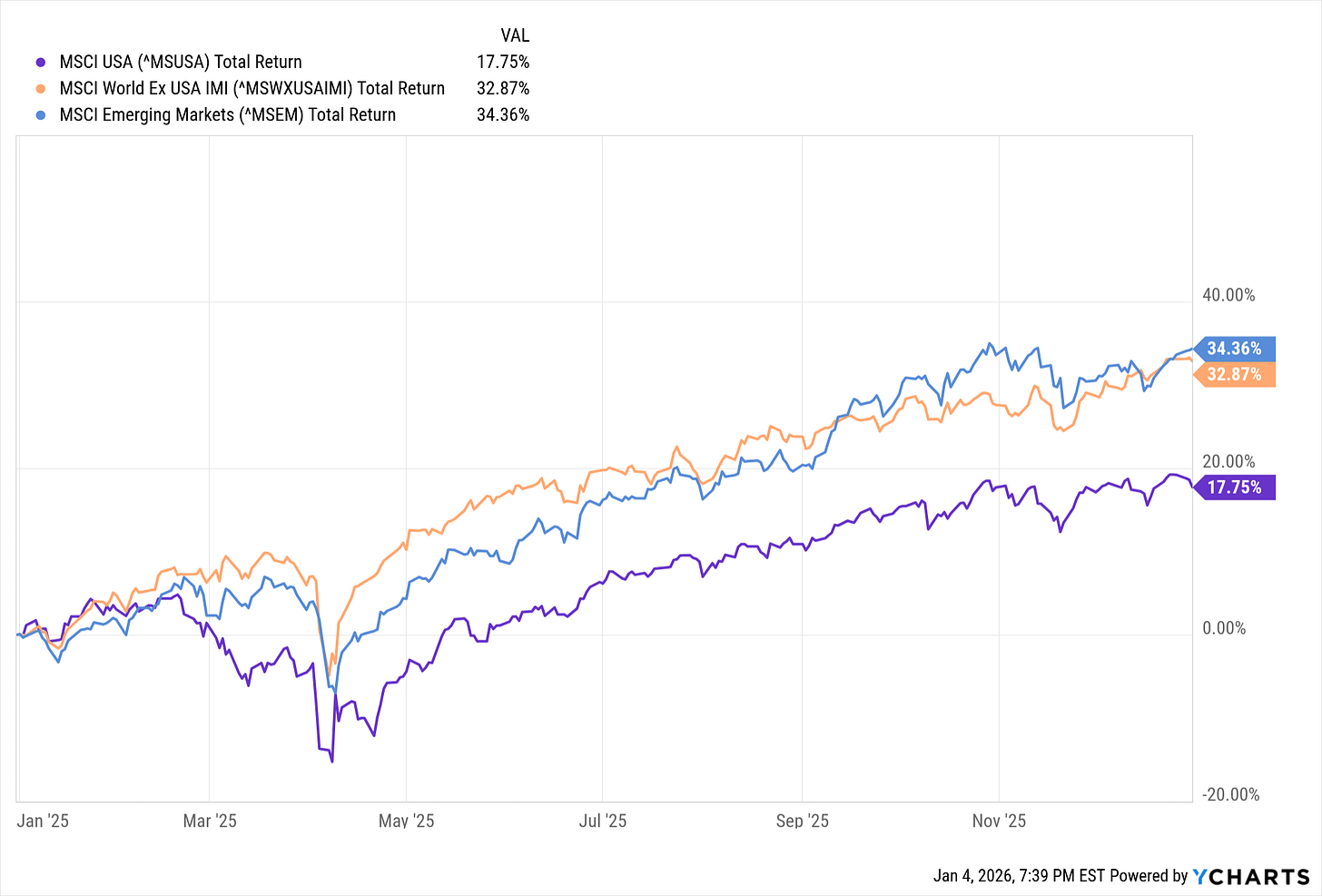

First, understand the S&P 500 represents 50% of the global market. It’s very important but not the entire market. Our goal is to capture its returns, not beat them through market timing.

Second, we don’t have to predict short-term movements. Rather the goal is to align your risk and investment time horizon to deliberately size positions within the portfolio across company size and geography.

Since we can’t predict which markets will lead in any given year, diversification becomes essential. 2025 proved this perfectly: while the US markets had another strong year (purple line), international and emerging markets performed twice as well (orange and blue lines, respectively). A prudent allocation includes some portion of all three to capture the entire market. No prediction required.

If I were to ask you to guess what the market will do in 2026, what would you say?

Hopefully by now I’ve convinced you not to guess.

But there will likely be some very pessimistic people, given three straight great years. Then a few optimists, based on overwhelming historical data. Many logical people might say “somewhere around the average, perhaps 8-12%.”

Seems fair, let’s unpack that.

Averages Can Be Misleading

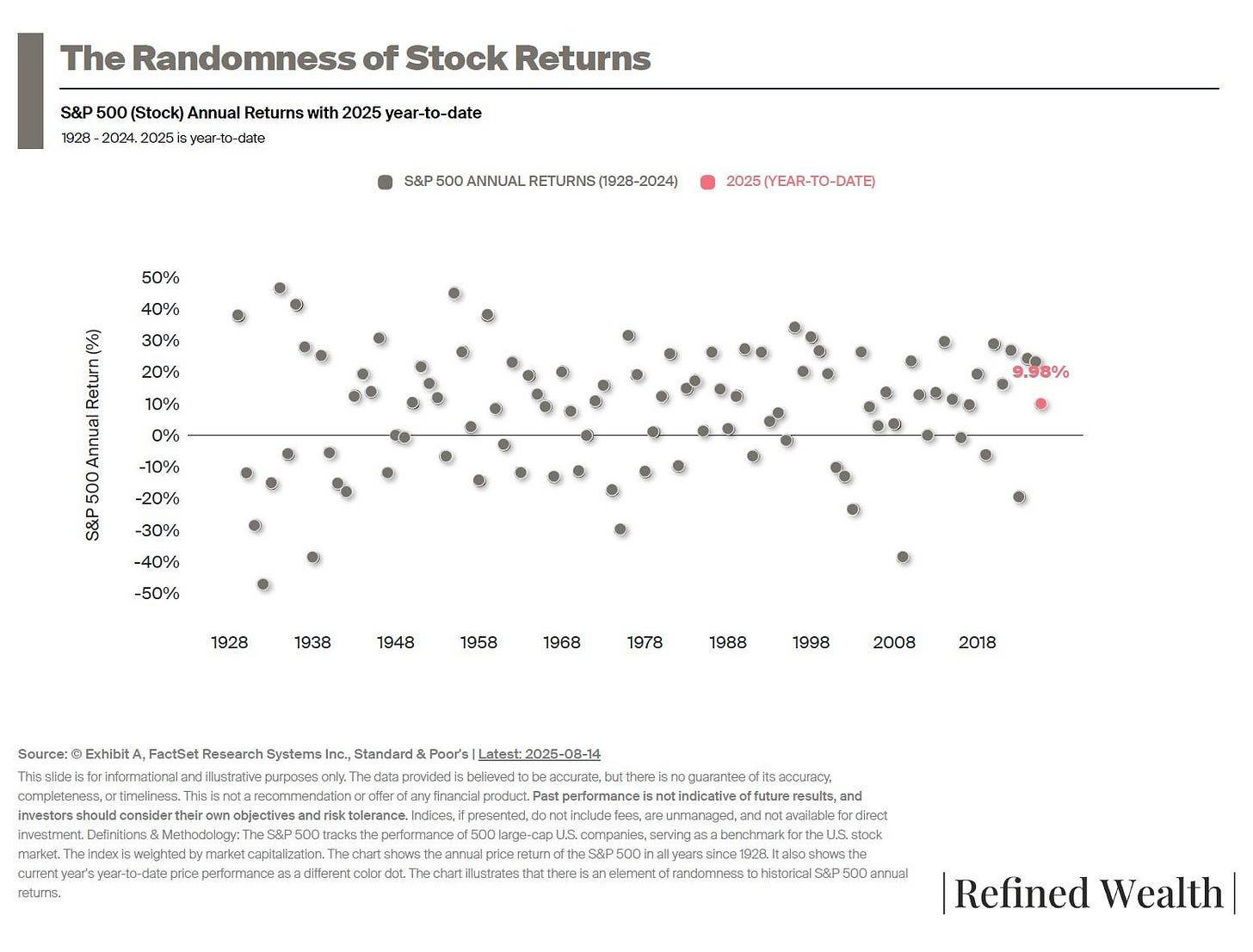

You may have inferred it from the chart above or the line of questioning, that averages don’t tell the whole story.

Since 1926, the S&P 500 has averaged 10% annual returns. But here’s the catch: the S&P 500 Index had a return within the 8-12% range in only 6 of the past 93 calendar years. (The Uncommon Average)

This is caused by big up years and big down years. You can call it volatility or perhaps just sheer randomness of returns. The only pattern I see is that there are more data points above 0% than below it.

Warren Buffett’s mentality:

“I’d rather have a lumpy 15% return than a smooth 12% return.”

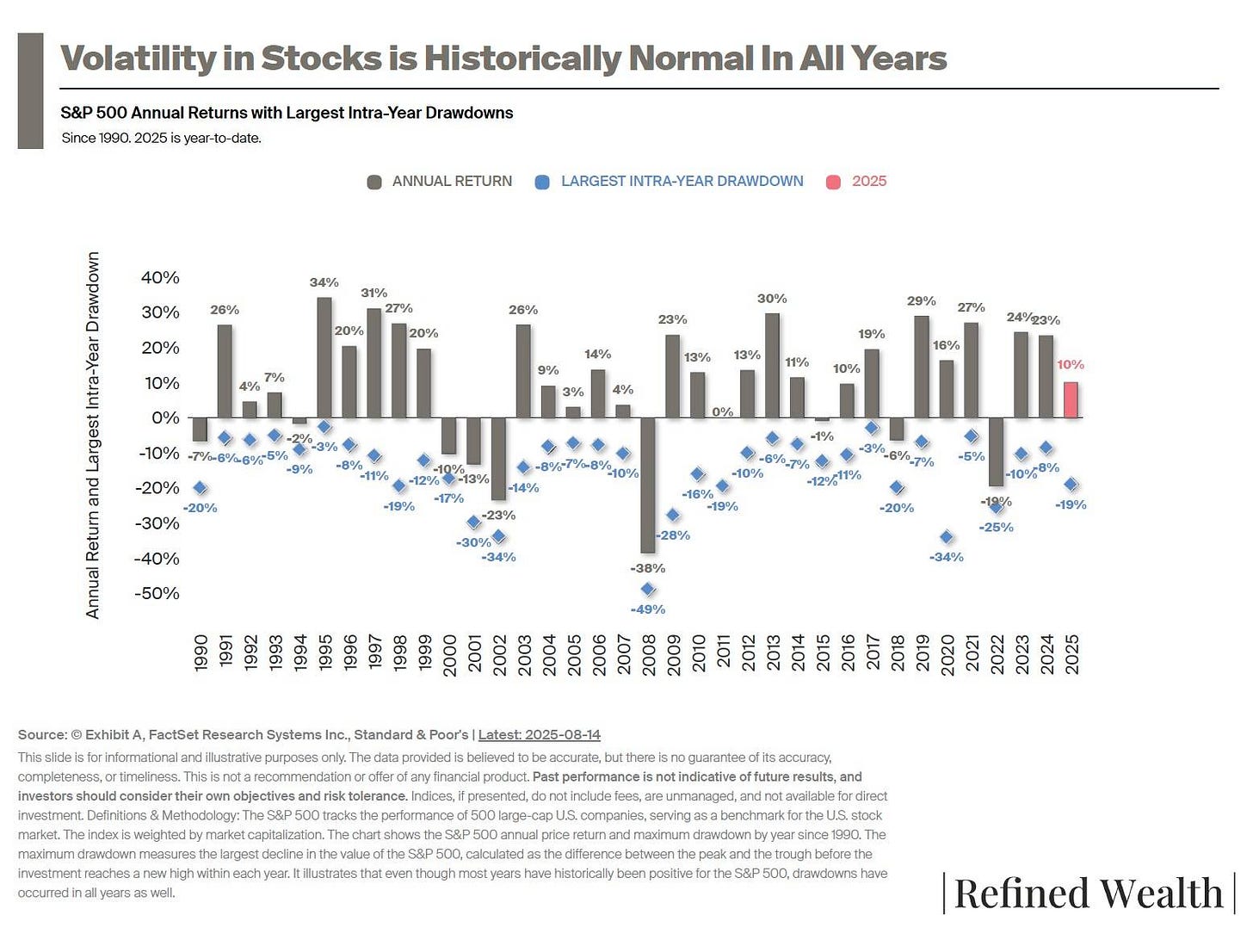

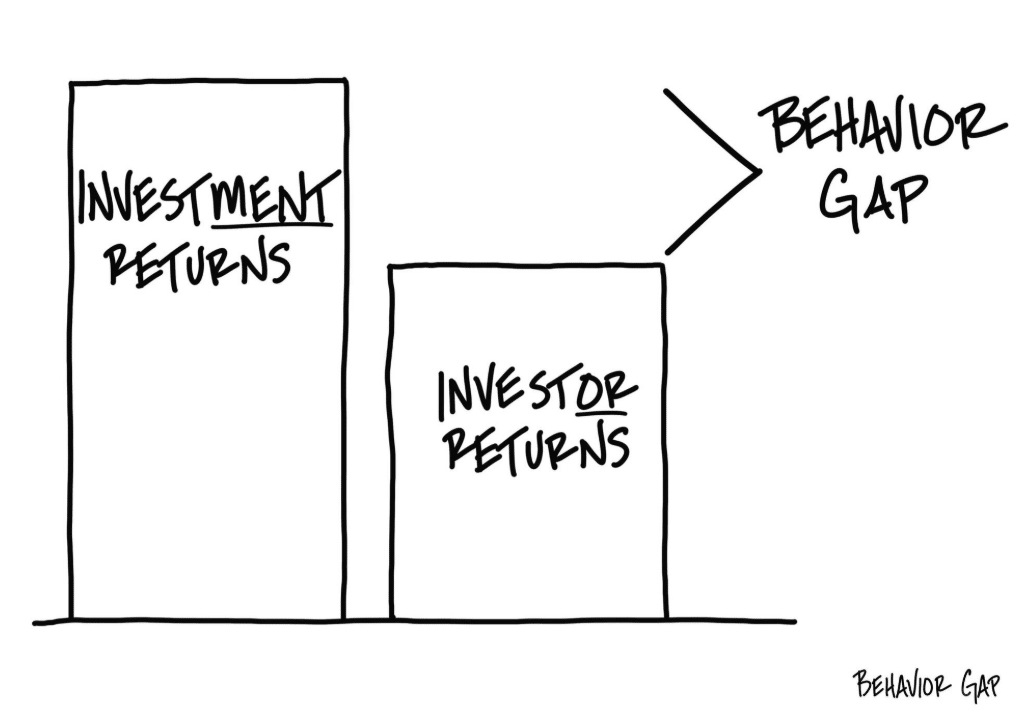

Many people act in the complete opposite manner. Investing is emotional, and many of us anchor to our latest net worth milestone. When things get bumpy, we often can’t take it for too long.

That’s when people exit the market at exactly the wrong time and often stay out until another drop - which may or may not ever occur at the level where they exited.

The Value of Staying the Course

Most years include intra-year drawdowns, and every few years the market ends in negative territory. Opportunities to make mistakes.

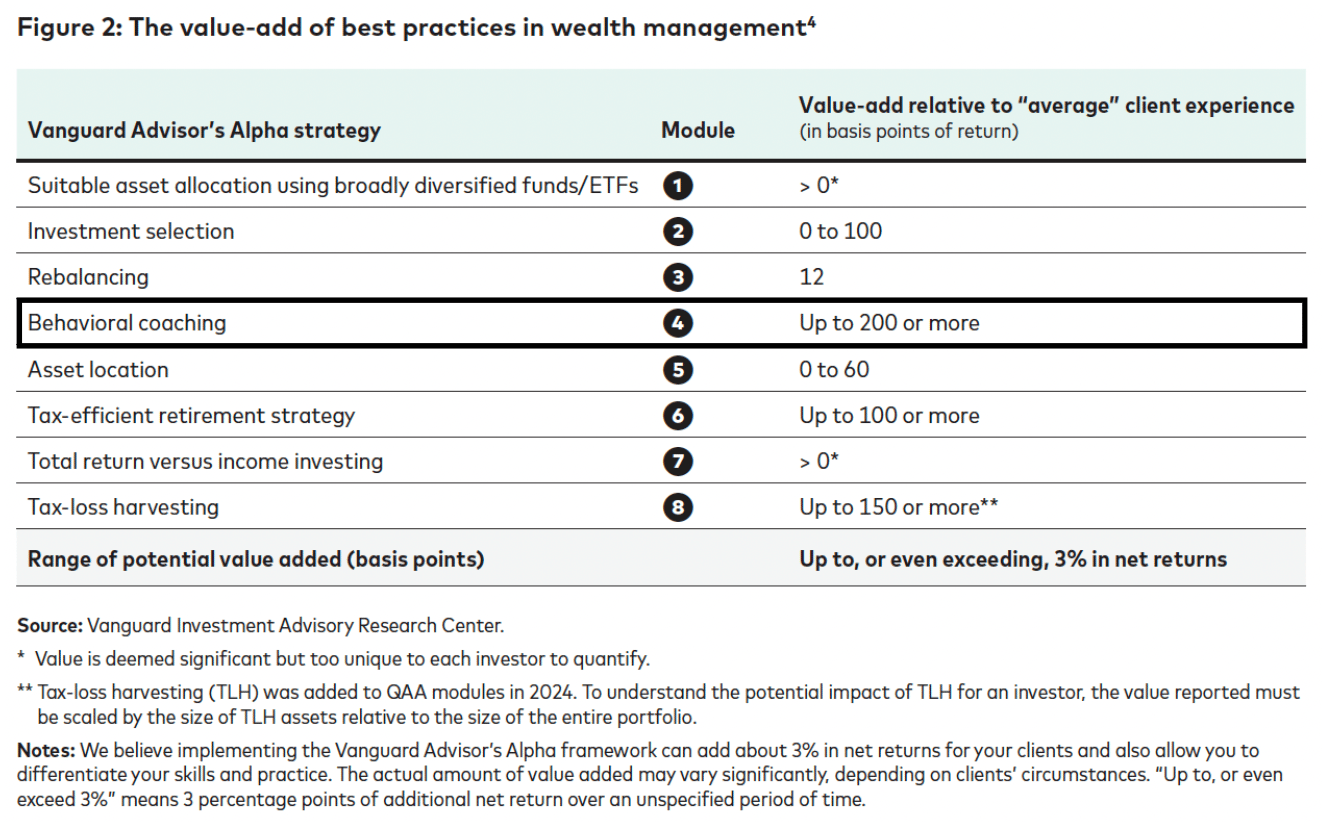

Vanguard’s Advisor Alpha “Potential value-add: Vanguard research and other academic studies have concluded that behavioral coaching may add 100 to 200 bps (1-2%) in net return. Providing discipline and guidance could be the largest potential value-add of the tools available to advisors.”

This 1-2% gap compounds dramatically over time. Everything I do is designed to prevent my clients from making big mistakes. This involves education, appropriate risk management, diversification, cash reserves, and more. All to ensure that—not if, but when—the market drops, we’re positioned to weather the storm.

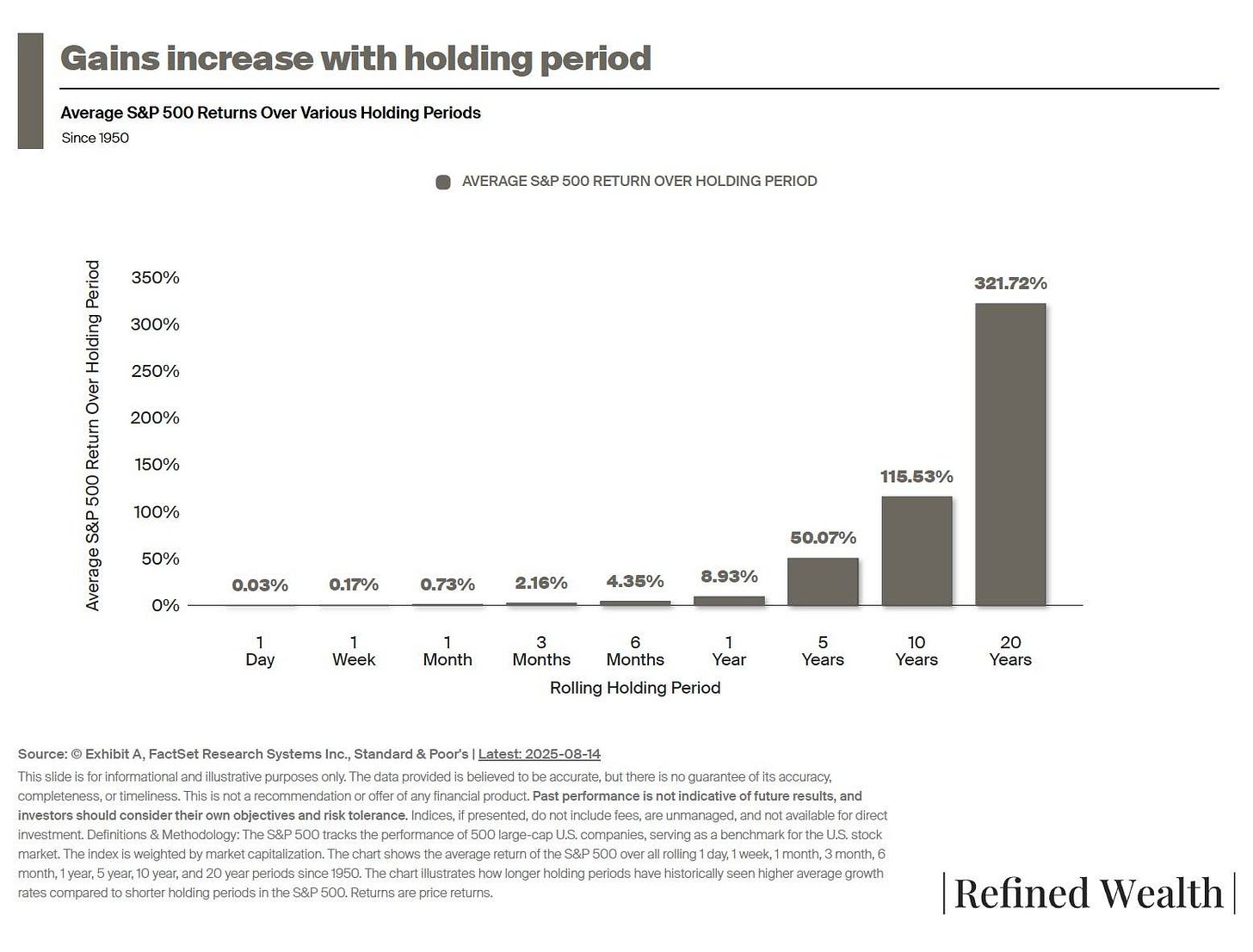

The truth is that I don’t know what will happen over the next day, week, month, or year. No one does.

But if we use history as our guide, we can have a good sense of what’s likely over the next decade or two. We’ll plan accordingly, building a strategy that lets us weather the storms and capture what the market offers over these periods.

As always, stay the course.

Joe Ward, CFP®, RICP®

If you’d like to join my free private client newsletter, subscribe here.

For just the public posts, subscribe below.